Hire Remote Accountants for Your Business Needs

Discover top remote bookkeeping services and expert business advisors for your business at Adea Company. Elevate your accounting today.

COMMUNITY

Work with highly qualified, vetted accountants and onboard them without the overhead of traditional hires. At Adea Company we bring you the world’s best because that’s what your company deserves.

Supported Software

Bring Expertise to Your Company

Let’s start the journey towards success and enhance revenue for your business. Take your company to the next level.

Vetted Accountants

Spend less time interviewing and more time building by connecting with accountants we’ve already assessed.

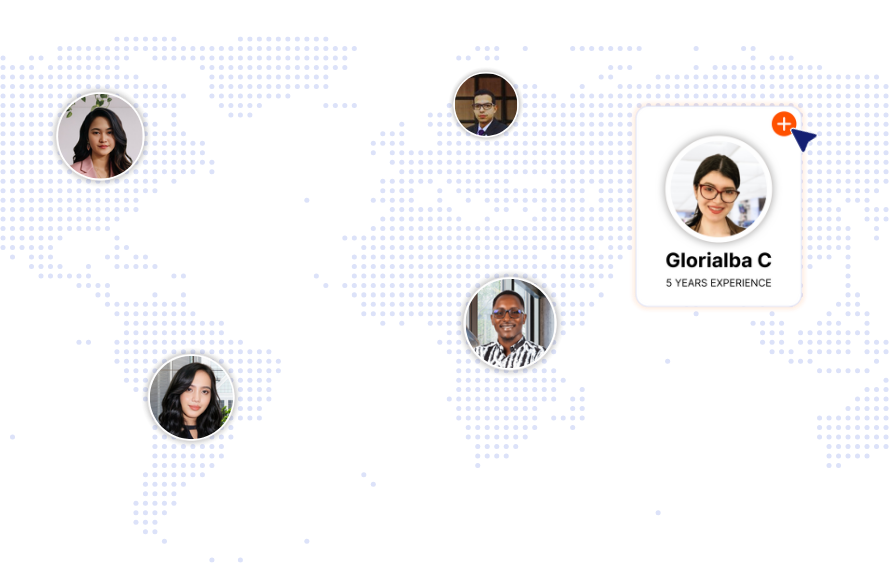

Global Talent

Tap into a talent pool that spans multiple regions and multiple countries. The best accountants aren’t always in your backyard.

Regulatory Compliance Match

Identify the best-fit accountants from our network through our proprietary compliance matching process.

Hands-On Support

From helping with onboarding to sharing best practices, our success team is there every step of the way.

“Every one of the AdeaCompany accountants I have worked with has been stellar. They are great accountants, really driven to deliver, and they’re just great people.”

Rob HelmickBioSource Advisors.

“Every one of the AdeaCompany accountants I have worked with has been stellar. They are great accountants, really driven to deliver, and they’re just great people.”

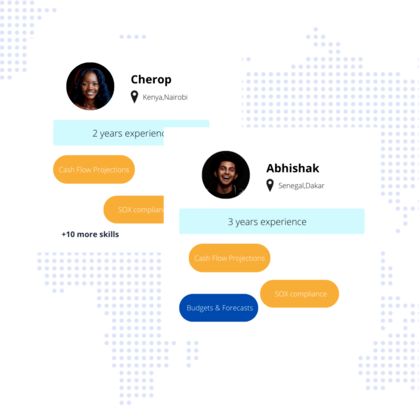

Our Community

Who have come together to develop their skills, learn from each other, and grow their careers

Skills include Financial Reporting, Process Development, Cash Flow Projections, SOX compliance, Software implementations , Budgets & Forecasts many more.

With a geographic footprint that covers Africa, South America, Eastern Europe, and many more.

What Our Clients Are Saying

Our clients' success is our greatest achievement. Here are some stories from businesses who have trusted us to meet their needs and exceed their expectations.

Tailor your work to your needs

Hire Talent

Implement Managed Projects

Grow Your Business with Our Expert Tips

artificial intelligence

Can artificial intelligence replace accountants?

Whether you’re a fan of AI-powered automation tools or still skeptical about their benefits, there’s no denying that accounting automation is here to stay.

artificial intelligence

Can artificial intelligence replace accountants?

Whether you’re a fan of AI-powered automation tools or still skeptical about their benefits, there’s no denying that accounting automation is here to stay.